About Us

Pebble Beach Wealth Fund is a boutique wealth management firm located in Silicon Valley. Pebble Beach Wealth Fund coordinates the financial affairs of a limited number of clients by implementing a consultive Wealth Management process. We are a fee based company, specializing in long-term investment strategy and dynamic portfolio design. We only take new clients when we have determined that we can substantial value to those clients’ financial situations.

Using passive, low-cost strategies for investments and a consultative and collaborative approach to wealth management, Pebble Beach Wealth Fund is able to have a tremendous impact for our select clients.The consultative process identifies the specific challenges that clients face in reaching their goals and enables us to build an investment plan designed to help overcome those issues.

Opportunity and Solution

One of the key opportunities available to those managers able to combine hedge fund strategies with more traditional asset management techniques is the vast difference in available investor dollars.

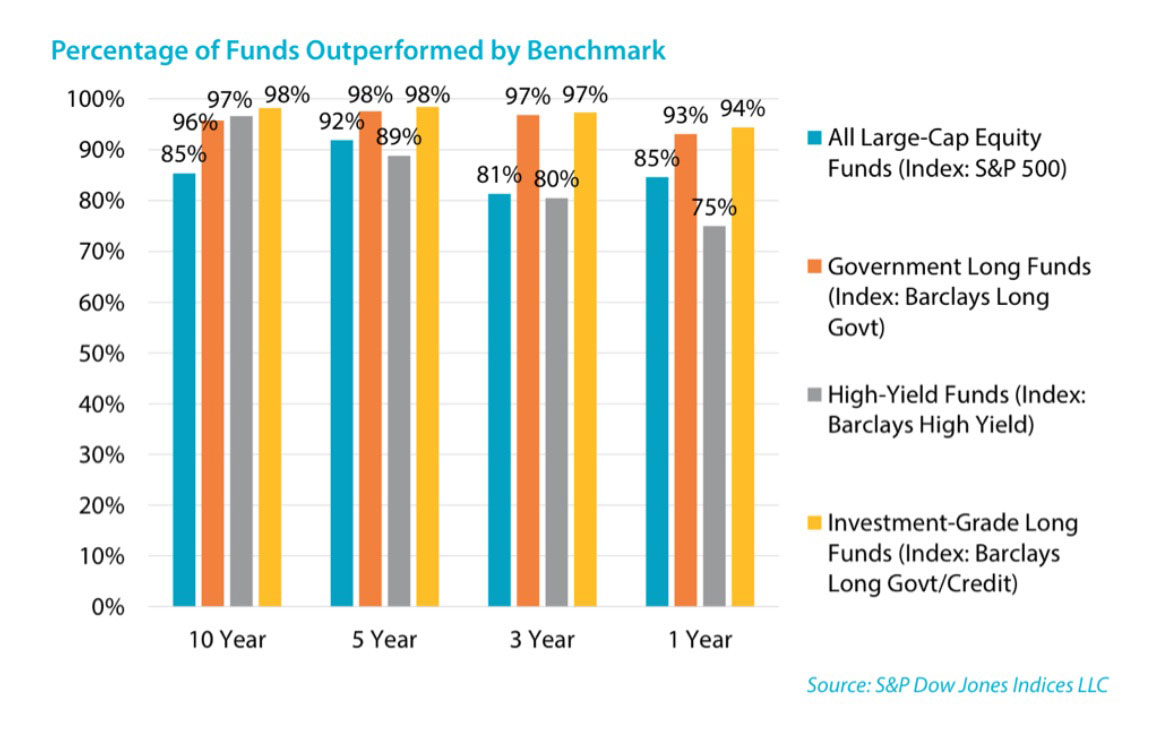

Traditional investment mandates are much larger than alternative mandates: 85-90% versus 10-15% of total portfolio allocations. Given the performance challenges faced by traditional managers and the fee pressure on hedge fund managers, traditional and hedge fund investment approaches are converging, thereby developing active hybrid products.

Using hedge fund technology to extract uncorrelated return and long-only traditional techniques to achieve market exposure, better-performing produts should evolve. As these products develop, clients stand to benefit from better performance within their traditional mandates and alternative asset managers stand to benefit from avaiable assets to manage.

Given the skillset needed to implement alternative trading strategies and track records which speak to alpha capture, a select subset of alternative managers are well positioned to design these products and compete for traditional asset management mandates.

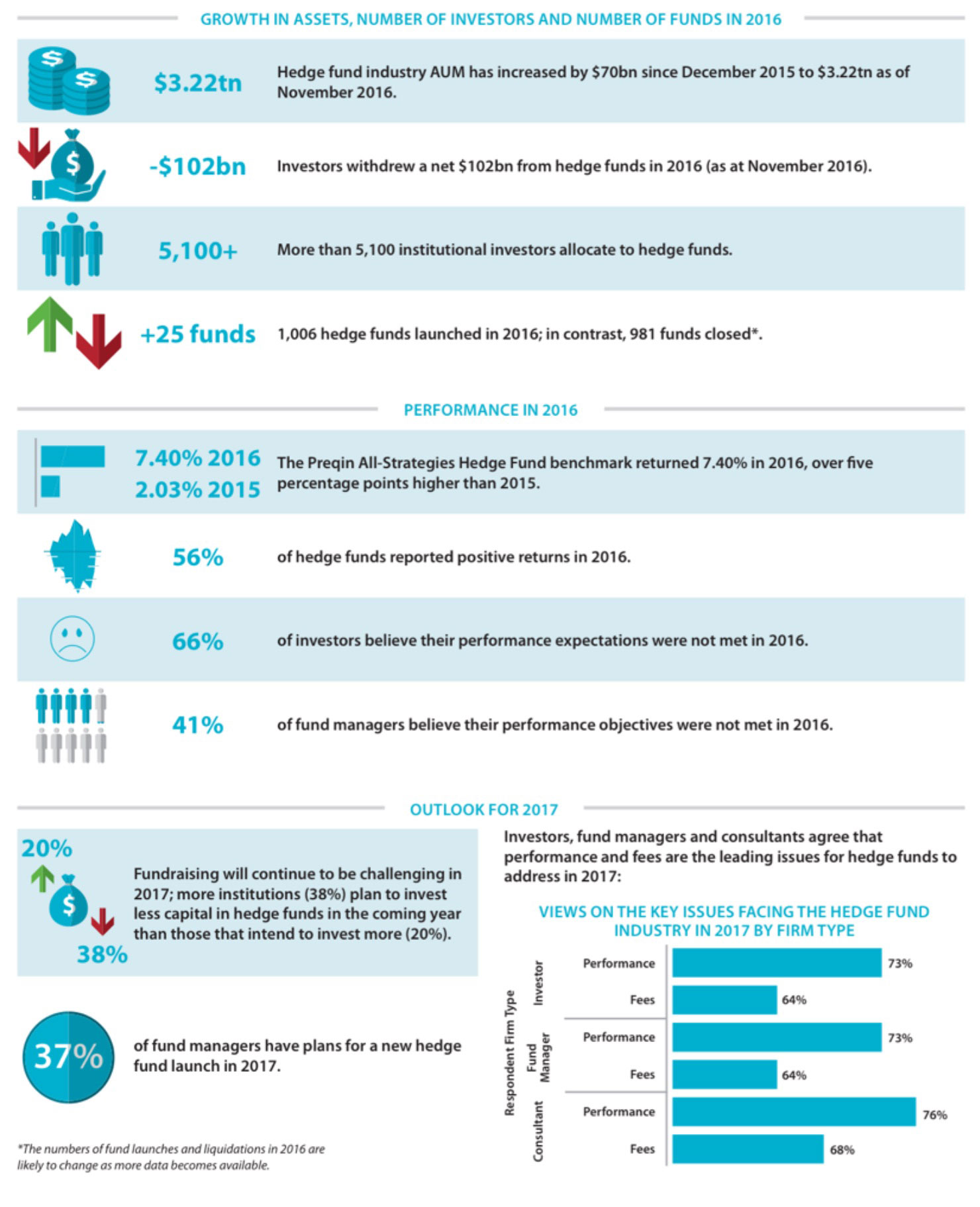

Hedge Funds: 2016 in Numbers

Asset Flows

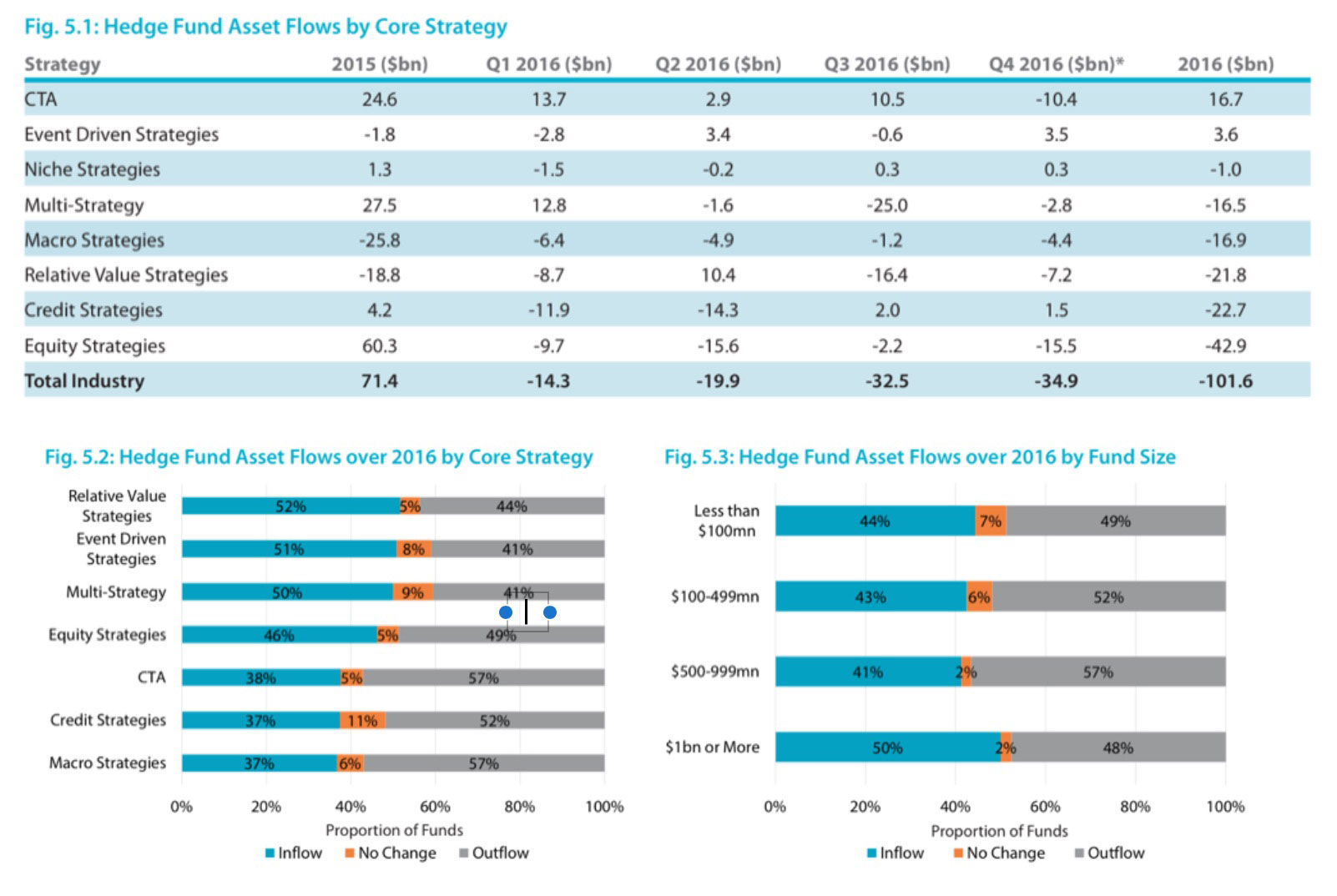

PBWF Online database holds performance and asset data for over 15,000 hedge funds. Using this extensive coverage, PBWF is able generate estimates of the capital fl owing in and out of the industry, and determine which strategies and regions have seen net growth or a decline in assets over the course of 2016 as at 30 November 2016.

NEGATIVE FLOWS, POSITIVE PERFORMANCE

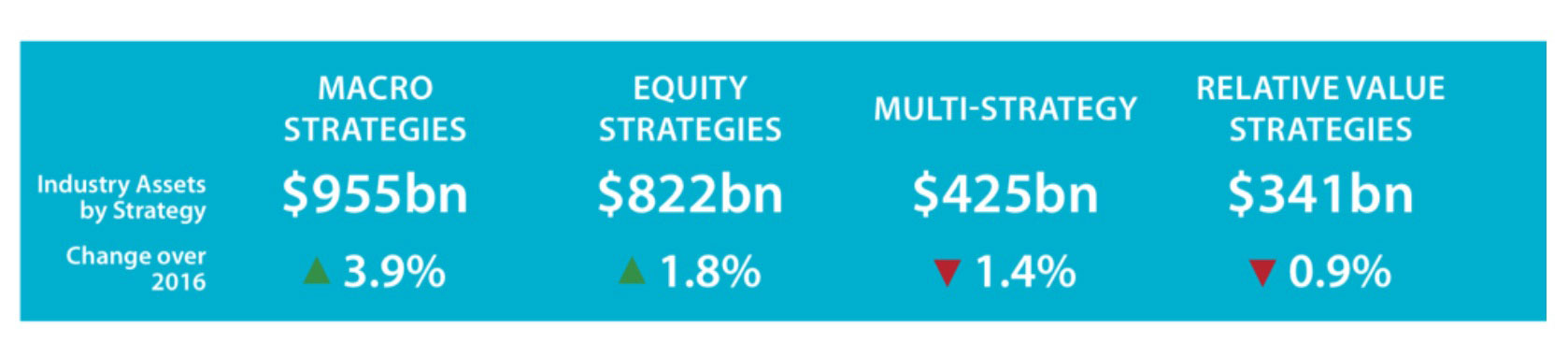

Following a year of strong infl ows in 2015, the industry saw net outflows of $102bn in 2016 (Fig. 5.1), with 54% of hedge funds recording net outflows over the course of the year as performance and fee concerns saw some investors pull capital from hedge fund portfolios. Credit and equity strategies recorded the largest net outflows over the year; however, the total assets of equity strategies funds increased by 1.8% over 2016, driven by an annual net return of 6.65%.

Investor sentiment towards CTAs, however, is strikingly different to that of hedge funds: CTAs have attracted $17bn in new capital in 2016 as investors look for sources of uncorrelated returns. Despite the majority of hedge fund strategies recording net investor

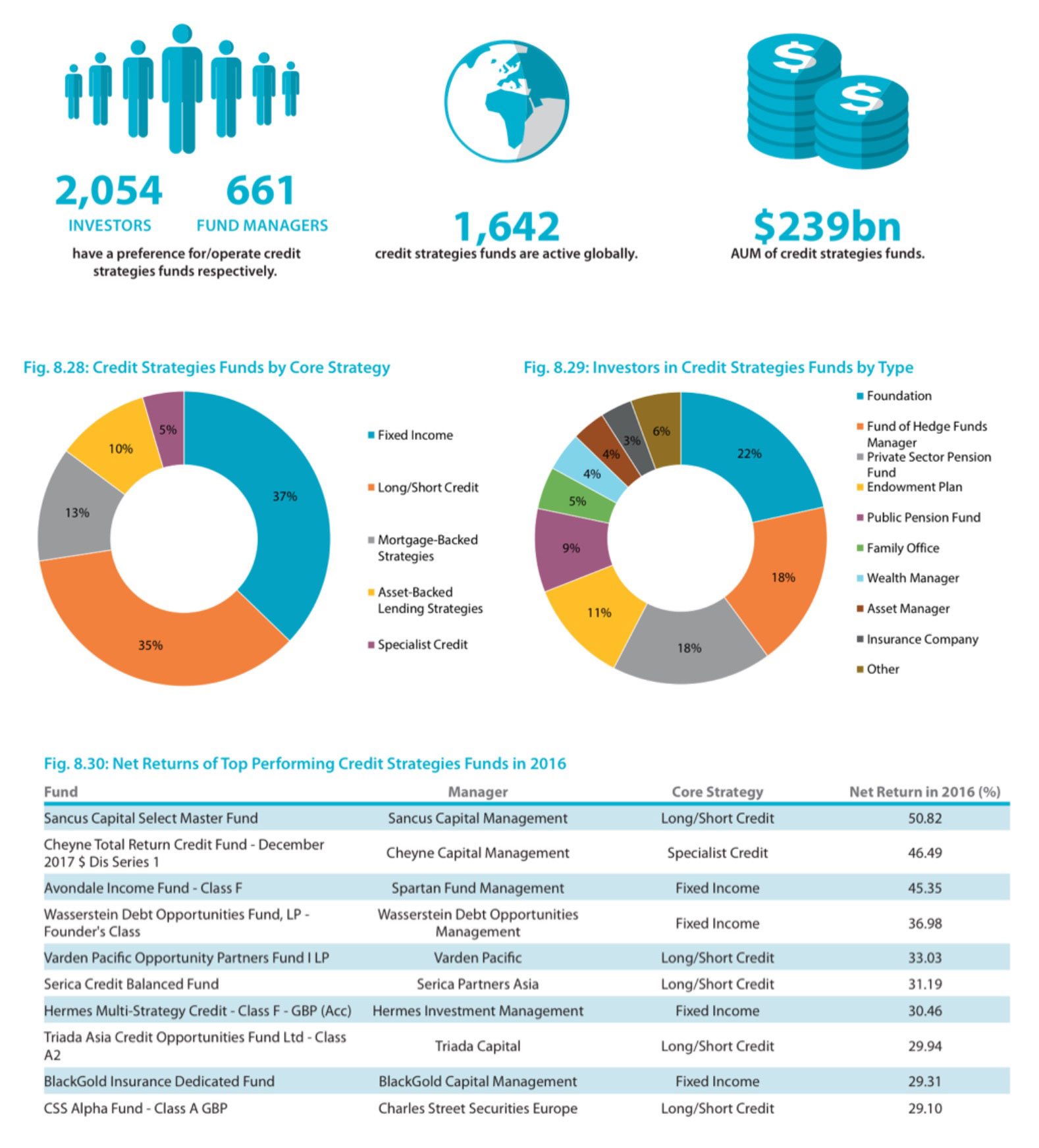

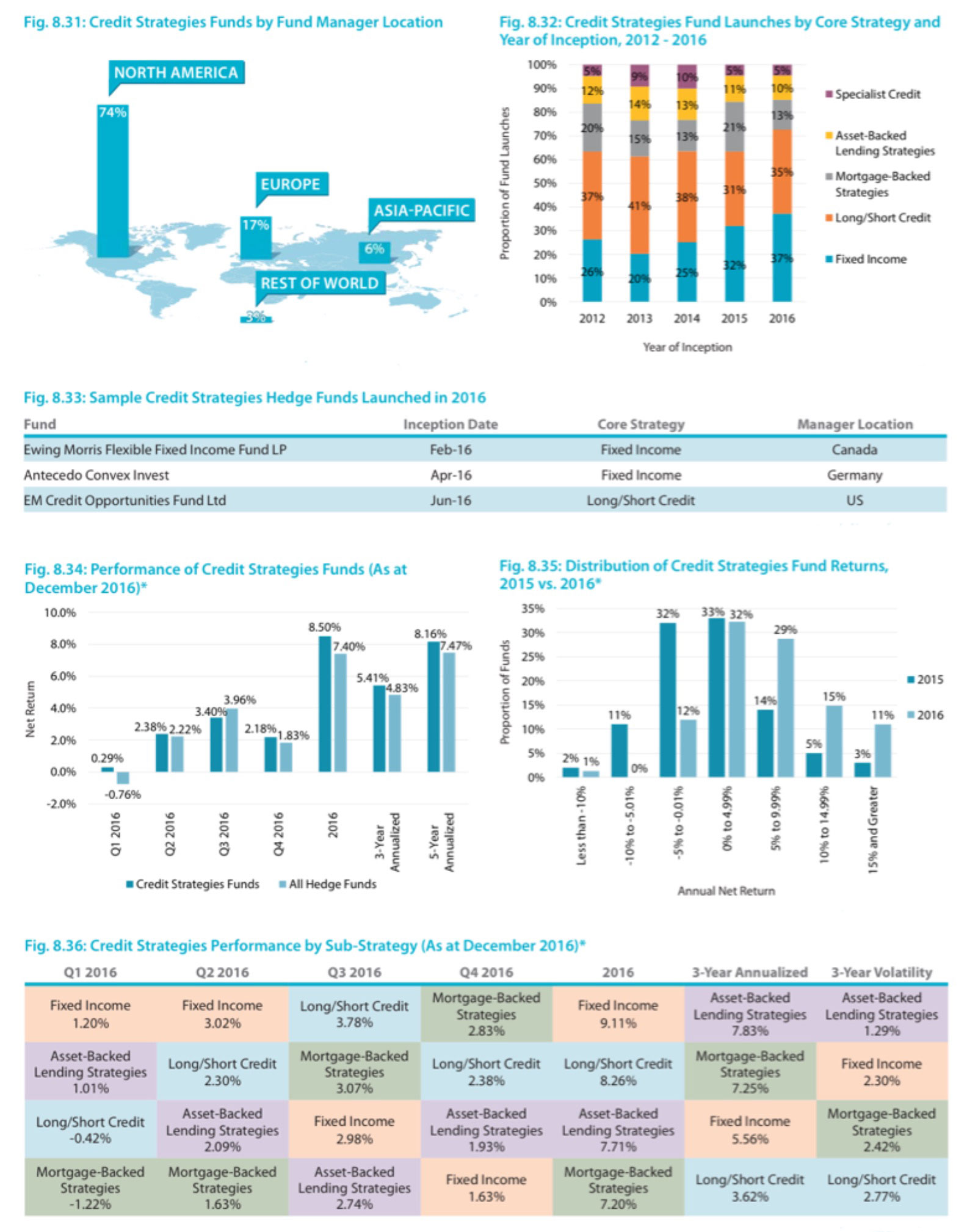

Credit Strategies

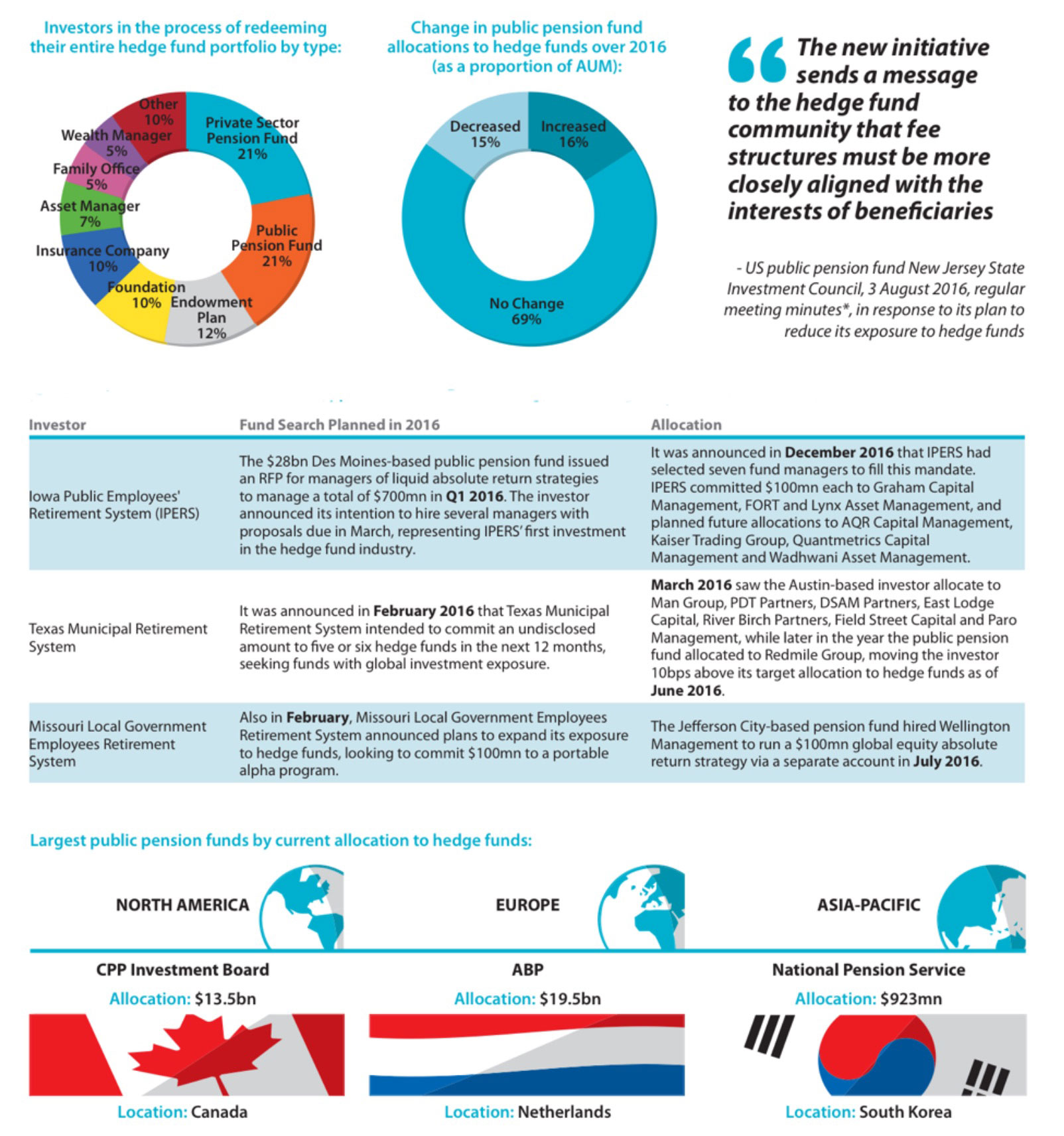

In Focus: Public Pension Funds

Korea’s major public funds are marching in

Setting the new direction for the new wave of South Korea’s public funds is the NPS with its AUM worth 363trn won ($322bn) of which 14% is invested overseas...

Learn More